Bookkeeping by Mehasa Consulting

- +447513300730

- [email protected]

- W1H London

Virtual Accounting vs. In-House: The Ultimate Choice for Your Business Success

Virtual Accounting vs In-house

Basis of virtual accounting vs in-house

Location Gets the work done sitting at a desk in your business office Get their work done online from the location of their choice.

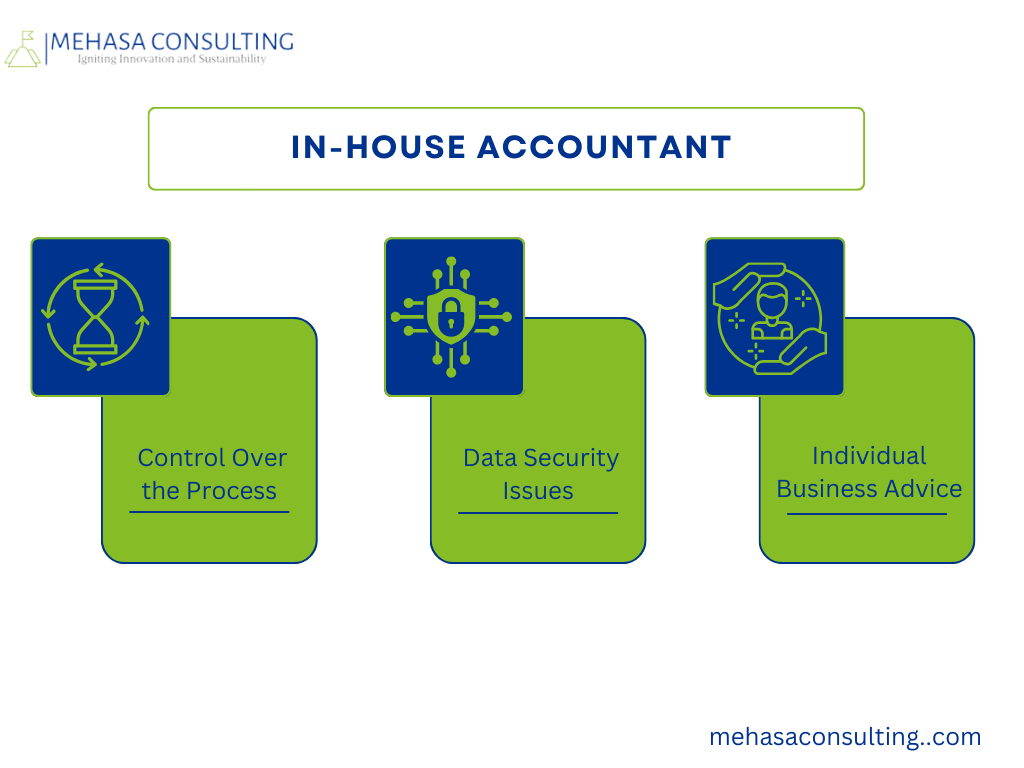

Recruitment Process: The recruitment process for an in-house accountant is your responsibility, and to do so efficiently, you must screen them properly. But if you are not an accounting expert, this process will be a problematic one. If you are hiring a virtual accountant service from an outsourced accounting services provider, they will be responsible for the selection of the right virtual accountant for you. Service providers are a better judge of the expertise of accountants as they have extensive experience in doing so.

Quality The quality of work is dependent on your recruiting skills. Just in case you hire someone who lacks any skills that you need in your accountancy, you cannot expect high-quality work and, at some point, may witness some inefficiency. After the right selection of accounting service provider, you will rarely find any issue with quality as long as you communicate your requirements accurately.

There is accounting software that makes the accounting process a breeze for most businesses. However, due to some reason, if businesses can’t invest in software, it is difficult to get access to accounting information. Virtual accountants always work on cloud-based software, which makes it easier to access financial data from any device and any location.

Paperwork Conducting accounting traditionally by an in-house accountant without accounting software leads to a mountain of paperwork to work with. Keeping track of all this paperwork and maintaining the physical books can turn out to be challenging and time-consuming. Virtual accountants conduct accounting using popular accounting software. This makes it easier to maintain and update all financial details easily with minimum use of paperwork.

Growth & Downsizing Hiring or firing human resources is easier said than done, and there are restrictions in terms of other variables that can’t be downsized or increased as per the dynamic requirement. Growth or downsizing is an ease in terms of a virtual accountant. Here, you can increase or decrease the number of virtual accountants working for you without the stress of infrastructure needs.

Industry Knowledge When hiring an in-house accountant, you must ensure that they have prior work experience in the same industry; otherwise, the expense and time invested in training will be significant. You can choose from a wide array of virtual accountants who have worked for diverse industries or virtual accountants who specialize in your industry.

Cost A full-time in-house accountant can cost you about $70,000 for a year, which is exclusive of overhead costs. Superannuation, contributions to employee retirement schemes, fringe tax, child support, employee income tax, office space, IT system, and similar overhead costs can add up to about 20% of the base salary. Virtual accountants are not your employees; instead, they are contractors providing accounting services, and thus, overhead expenses are not incurred when you hire a virtual accountant. You can hire virtual accountants from Whiz Consulting for as low as A$3000 a month.

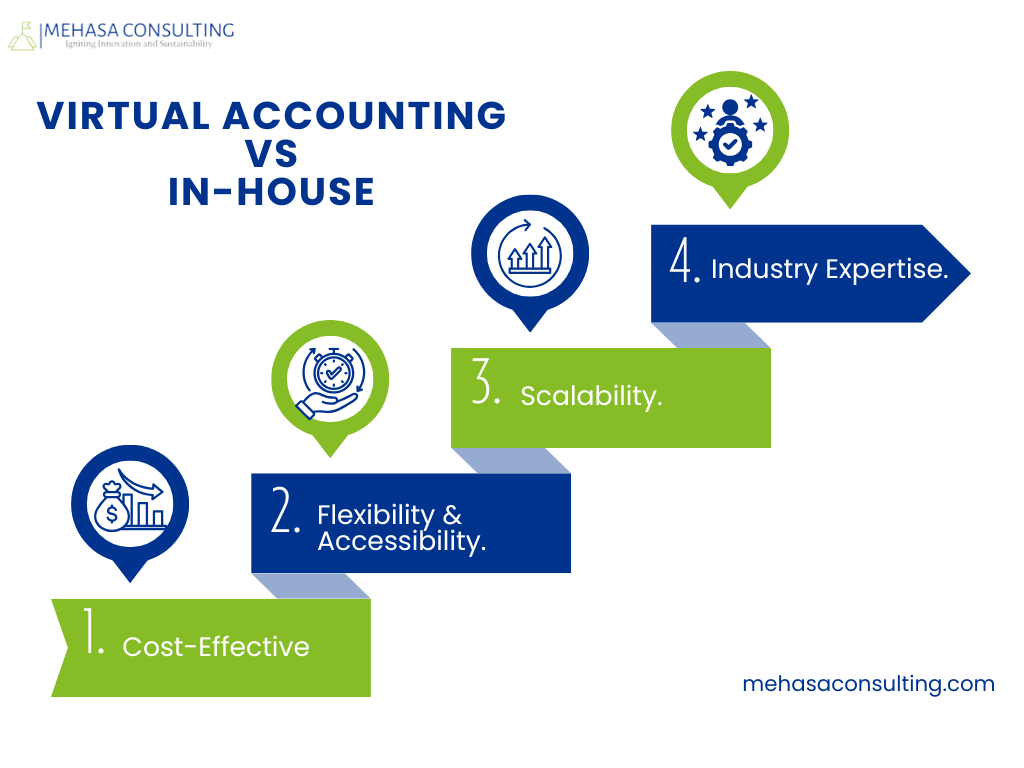

Virtual Accounting vs in-house: Advantages of Hiring a Virtual Accountant

Virtual accountants are very flexible, working from anywhere, and using cloud-based tools. This means that financial data can be accessed anywhere, and your accountant will easily adapt his working hours to fit into your business’s schedule. This is contrary to in-house accountants who are bound by office hours and may not be easily available in case urgent financial matters crop up after their office hours.

As your company grows, the same does your accounting needs. Virtual accountants can scale their services up or down quickly so you only pay for what you need at any point in time. Hiring or firing in-house accountants, on the other hand, is usually a time-consuming and quite HR- and law-sensitive process.

Virtual accounting firms usually have a team of professionals with expertise across various industries. Whether you are in retail, manufacturing, or technology, you can find a virtual accountant with experience in your field. This is particularly useful for businesses that require specialized accounting skills.

Virtual accountants will employ cloud-based accounting software with minimum paper and updated records in real time, leaving no chance of human mistakes that may lead to loss and disorganization in a firm. In-house accountants, particularly those using more than basic software, can often process and perform tasks using paper.

When Would You Choose an In-House Accountant?

Cost of virtual accounting vs in-house

Enjoy scalable, flexible, and secure accounting solutions with our partnership, help streamlining your financial processes, and improve the overall efficiency of your business. We let you take care of scaling your business while we take care of your financial health.