Bookkeeping by Mehasa Consulting

Role of Outsourced Bookkeeping Services in Business Success Effective financial management is one of the most significant factors for business growth and sustainability. Many businesses seek strategic solutions to streamline their operations and cut costs. Outsourcing key functions such as bookkeeping remains one of the most effective methods. You can hire local bookkeepers or even try to do everything on your own. However, the question is whether you have the time and resources to do so with the required efficiency. This is where outsourced bookkeeping services come into play as a smart, cost-effective, and efficient solution. If you have been wondering how outsourcing your bookkeeping will benefit your business, then keep reading to understand the advantages of third-party bookkeeping services and how they can take your business to a whole new level. What Are Outsourced Bookkeeping Services? It simply refers to hiring a third-party service provider that will take charge of your financial records and account management outside. Their usual services include transaction recording, reconciliation of accounts, processing payroll, preparation of financial statements, and tax compliance. The beauty of outsourcing your bookkeeping is the chance to concentrate more on running your business rather than training, managing, and equipping an in-house team. Whether small startup or large business, outsourced bookkeeping services can be customized to your needs at a fraction of the cost of hiring a full-time staff. Through your partnership with a credible bookkeeper, your business will get an access to the financial professionals who can correctly and securely manage your account. This means you’re free to focus on the activity driving your business forward. Cost Savings Outsourced bookkeeping services can also save quite some money as compared to the costs of employing an in-house team. They cut costs on salaries, benefits, office space, recruitment, and training. Additionally, outsourced services can be scaled up; that is, you only pay for what you require at any given time. This makes it particularly effective for SMEs requiring cheaper solutions. Access to Expertise Bookkeeping is technical knowledge in tax laws, accounting standards, and the best practices in finance. Access professionals who are updated on the latest financial regulations and industry standards by outsourcing your bookkeeping. This will ensure that your financial reports are accurate, compliant, and aligned with current tax trends. Higher Accuracy and Reliability Outsourcing will allow you to depend on the most advanced software and tools in managing your financial data. Automation reduces the rate of human error, hence the reliability of the data entry, reconciliation, and reporting tasks by experts who make use of the latest tools. This improves the speed and accuracy in the processing of complex financial activities. Scalability The needs of your bookkeeping increase as your business does. Scaling an in-house team is expensive and time-consuming. Outsourcing is flexible. You can change the services offered for your bookkeeping depending on the size of your business and its workload without adding any staff or infrastructure. That’s how your bookkeeping can grow with your business. More Security Financial data should be safeguarded against unauthorized people and cyber hackers. A legitimate outsourced bookkeeping provider will respect security. He or she will use encrypted systems and gadgets to protect your financial information. Outsourcing reduces the occurrence of breaches, and your financial books are safe. What a Bookkeeper Offered by the Outsourced Bookkeepers Outsourced bookkeepers are responsible for keeping your finance in order. Most offer services which involve: Recording Transactions Outsourced bookkeepers will help keep a record of every transaction going through the company, meaning that such information is seen to be relatively accurate. Account Reconciliation Bookkeepers always reconcile accounts by comparing internal records with bank statements for discrepancies and rectifying these, hence minimizing errors and ensuring accuracy. Payroll Processing It is relatively complex to handle payroll; however, services can outsource payroll calculations, tax filings, and compliance with labor laws to ensure timely and accurate payments to the employees. Financial Reporting A very important report by your outsourced bookkeeper will include profit and loss statements, balance sheets, and cash flow statements that will guide your business regarding its financial standing. Tax Preparation and Compliance There are enough assurances that the business will observe tax requirements by outsourcing. The tax documents will be prepared and filed professionally, along with the information concerning the regulatory changes that you would like to hear regarding this issue. Invoicing and Accounts Payable Bookkeeping outsourced services take care of your invoicing, accounts payable, and vendor payments in order for you to ensure timely payment and good cash flow. Accounts Receivable Management Outsourcing helps to track outstanding invoices, follow up with clients on payments, and manage accounts receivable for a steady income flow. How to Select the Right Outsourced Bookkeeper The following are some considerations when choosing an outsourced bookkeeping service: Experience and Expertise: The provider should have industry-specific experience and knowledge of tax laws and financial regulations. Technology and Tools: The provider should be using modern, secure software compatible with your systems. Data Security: Choose the provider that encrypts and uses secure platforms to safeguard your financial data. Range of Services: Ensure the service provider can provide services that include transaction recording to payroll processing. Communication: Communications with the partner are very necessary. The provider should be communicative and updated in time. Cost-Effectiveness: Compare the cost structures to get a provider that will not be outside your budget. Find one who is transparent about their prices so that you don’t encounter any hidden costs. Common Problems in Outsourcing Bookkeeping and Solutions Security Risks of Data Solution: Partner with a reputable provider who uses secure systems, encryption, and powerful access controls for your data’s protection. Communication Barriers Solution: Partner with one that allows for regular check-ins with real-time reporting and that has a proper way of communication to bridge every gap. Quality Control Solution: Look for a supplier that has in place quality control processes and reporting to ensure that financial records are accurate and reliable. Hidden Costs Solution: Look for a supplier that is transparent with the price and review the terms of the contract for fees. It gives a business the smart approach in order to streamline financial management while keeping it less expensive with greater accuracy. With an outsourced bookkeeping service, companies are free to concentrate on expansion as professionals handle all the details of the finance. Outsource bookkeeping to save in cost, security, and scalability to invest in long-term success. FAQs Q. How to outsource bookkeeping services? Review your business needs and determine a provider qualified to meet the needs you have. Be assured they are using safe, state-of-the-art technology. Q. How do I track outsourced bookkeeping? Use your financial statements to review their accuracy. Schedule regular reviews with your provider to hold them accountable for maintaining your quality. Q. How much does outsourced bookkeeping cost? This cost will depend on the size of the company, its industry, and the complexity of activities. Compare providers to get a price within your budget. Outsourcing your bookkeeping services, like Mehasa Consulting, positions your business for efficiency, growth, and financial clarity. Get started today!

Role of Outsourced Bookkeeping Services in Business Success

Effective financial management is one of the most significant factors for business growth and sustainability. Many businesses seek strategic solutions to streamline their operations and cut costs. Outsourcing key functions such as bookkeeping remains one of the most effective methods. You can hire local bookkeepers or even try to do everything on your own. However, the question is whether you have the time and resources to do so with the required efficiency. This is where outsourced bookkeeping services come into play as a smart, cost-effective, and efficient solution.

If you have been wondering how outsourcing your bookkeeping will benefit your business, then keep reading to understand the advantages of third-party bookkeeping services and how they can take your business to a whole new level.

What Are Outsourced Bookkeeping Services?

It simply refers to hiring a third-party service provider that will take charge of your financial records and account management outside. Their usual services include transaction recording, reconciliation of accounts, processing payroll, preparation of financial statements, and tax compliance.

The beauty of outsourcing your bookkeeping is the chance to concentrate more on running your business rather than training, managing, and equipping an in-house team. Whether small startup or large business, outsourced bookkeeping services can be customized to your needs at a fraction of the cost of hiring a full-time staff. Through your partnership with a credible bookkeeper, your business will get an access to the financial professionals who can correctly and securely manage your account. This means you’re free to focus on the activity driving your business forward.

Cost Savings

Outsourced bookkeeping services can also save quite some money as compared to the costs of employing an in-house team. They cut costs on salaries, benefits, office space, recruitment, and training. Additionally, outsourced services can be scaled up; that is, you only pay for what you require at any given time. This makes it particularly effective for SMEs requiring cheaper solutions.

Access to Expertise

Bookkeeping is technical knowledge in tax laws, accounting standards, and the best practices in finance. Access professionals who are updated on the latest financial regulations and industry standards by outsourcing your bookkeeping. This will ensure that your financial reports are accurate, compliant, and aligned with current tax trends.

Higher Accuracy and Reliability

Outsourcing will allow you to depend on the most advanced software and tools in managing your financial data. Automation reduces the rate of human error, hence the reliability of the data entry, reconciliation, and reporting tasks by experts who make use of the latest tools. This improves the speed and accuracy in the processing of complex financial activities.

Scalability

The needs of your bookkeeping increase as your business does. Scaling an in-house team is expensive and time-consuming. Outsourcing is flexible. You can change the services offered for your bookkeeping depending on the size of your business and its workload without adding any staff or infrastructure. That’s how your bookkeeping can grow with your business.

More Security

Financial data should be safeguarded against unauthorized people and cyber hackers. A legitimate outsourced bookkeeping provider will respect security. He or she will use encrypted systems and gadgets to protect your financial information. Outsourcing reduces the occurrence of breaches, and your financial books are safe.

What a Bookkeeper Offered by the Outsourced Bookkeepers

Outsourced bookkeepers are responsible for keeping your finance in order. Most offer services which involve:

Recording Transactions

Outsourced bookkeepers will help keep a record of every transaction going through the company, meaning that such information is seen to be relatively accurate.

Account Reconciliation

Bookkeepers always reconcile accounts by comparing internal records with bank statements for discrepancies and rectifying these, hence minimizing errors and ensuring accuracy.

Payroll Processing

It is relatively complex to handle payroll; however, services can outsource payroll calculations, tax filings, and compliance with labor laws to ensure timely and accurate payments to the employees.

Financial Reporting

A very important report by your outsourced bookkeeper will include profit and loss statements, balance sheets, and cash flow statements that will guide your business regarding its financial standing.

Tax Preparation and Compliance

There are enough assurances that the business will observe tax requirements by outsourcing. The tax documents will be prepared and filed professionally, along with the information concerning the regulatory changes that you would like to hear regarding this issue.

Invoicing and Accounts Payable

Bookkeeping outsourced services take care of your invoicing, accounts payable, and vendor payments in order for you to ensure timely payment and good cash flow.

Accounts Receivable Management

Outsourcing helps to track outstanding invoices, follow up with clients on payments, and manage accounts receivable for a steady income flow.

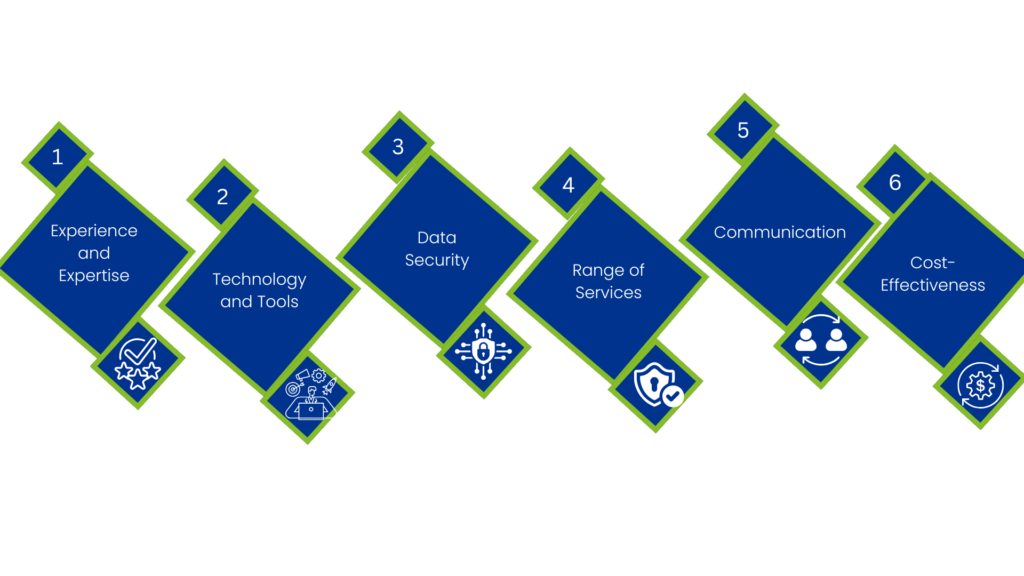

How to Select the Right Outsourced Bookkeeper

The following are some considerations when choosing an outsourced bookkeeping service:

Experience and Expertise: The provider should have industry-specific experience and knowledge of tax laws and financial regulations.

Technology and Tools: The provider should be using modern, secure software compatible with your systems.

Data Security: Choose the provider that encrypts and uses secure platforms to safeguard your financial data.

Range of Services: Ensure the service provider can provide services that include transaction recording to payroll processing.

Communication: Communications with the partner are very necessary. The provider should be communicative and updated in time.

Cost-Effectiveness: Compare the cost structures to get a provider that will not be outside your budget. Find one who is transparent about their prices so that you don’t encounter any hidden costs.

Common Problems in Outsourcing Bookkeeping and Solutions

Security Risks of Data

Solution: Partner with a reputable provider who uses secure systems, encryption, and powerful access controls for your data’s protection.

Communication Barriers

Solution: Partner with one that allows for regular check-ins with real-time reporting and that has a proper way of communication to bridge every gap.

Quality Control

Solution: Look for a supplier that has in place quality control processes and reporting to ensure that financial records are accurate and reliable.

Hidden Costs

Solution: Look for a supplier that is transparent with the price and review the terms of the contract for fees.

It gives a business the smart approach in order to streamline financial management while keeping it less expensive with greater accuracy. With an outsourced bookkeeping service, companies are free to concentrate on expansion as professionals handle all the details of the finance. Outsource bookkeeping to save in cost, security, and scalability to invest in long-term success.

FAQs

Q. How to outsource bookkeeping services?

Review your business needs and determine a provider qualified to meet the needs you have. Be assured they are using safe, state-of-the-art technology.

Q. How do I track outsourced bookkeeping?

Use your financial statements to review their accuracy. Schedule regular reviews with your provider to hold them accountable for maintaining your quality.

Q. How much does outsourced bookkeeping cost?

This cost will depend on the size of the company, its industry, and the complexity of activities. Compare providers to get a price within your budget.

Outsourcing your bookkeeping services, like Mehasa Consulting, positions your business for efficiency, growth, and financial clarity. Get started today!