Bookkeeping by Mehasa Consulting

- +447513300730

- [email protected]

- W1H London

A Guide to Law Firm Accounting

Legal accounting is such a difficult topic even to lawyers that have the practice with handling legal cases like everyone’s business. So much more lawyers that handle case procedures like nobody’s business end up not having known or being familiar with any thing about accounting principles, just because accounting is normally out of what lawyers spend in law school years learning. Despite having no formal training in it, lawyers usually become administrators of accounting records, track hours billed, and manage trust accounts. This is the ultimate law firm accounting guide. The information below will help you understand your financial processes, comply with all the requirements, and create best practices for your law firm.

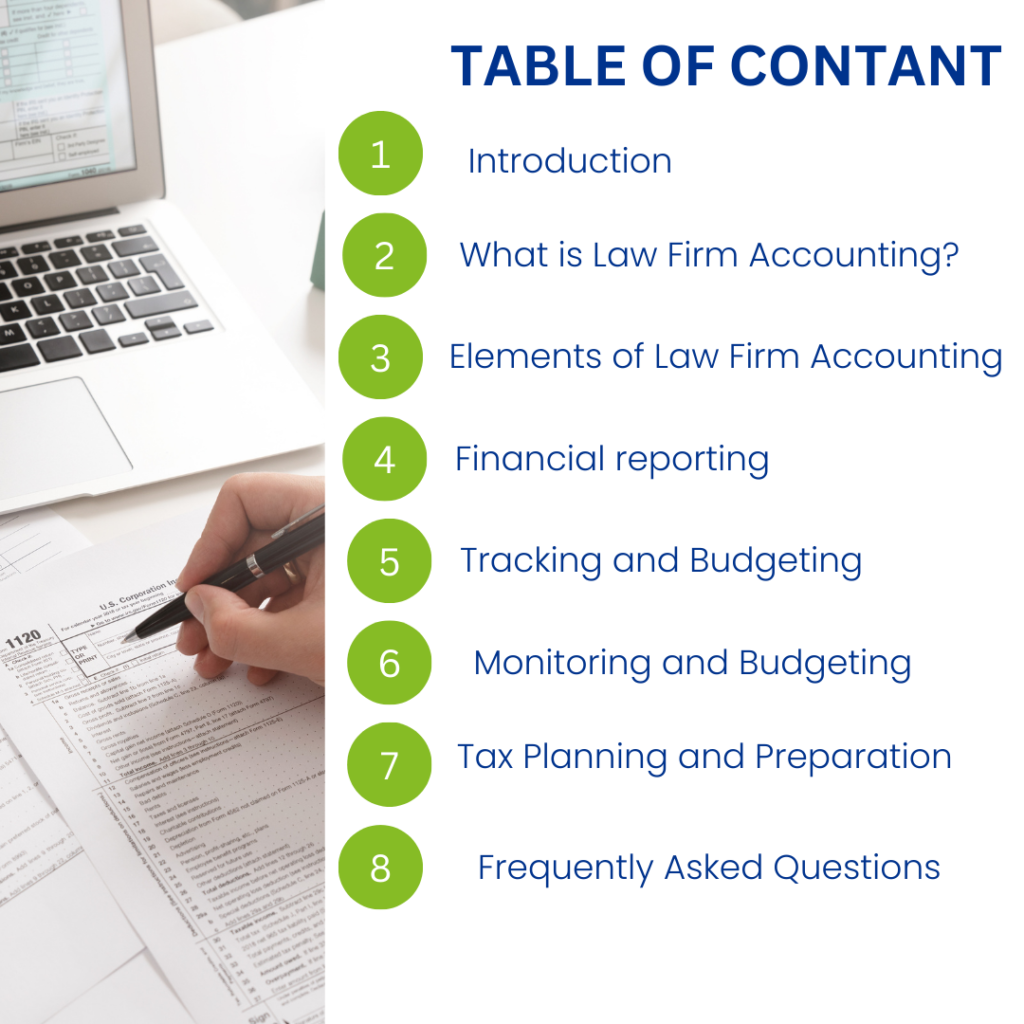

What is Law Firm Accounting?

Legal accounting refers to the management of all financial documents and transaction going on with a legal practice on a daily basis. It refers to any practice of law; it will consist of transactions over the clients’ money as well as industry-specific regulatory compliance clearing up financial accounts.

The major operations in legal accounting include

Preparation charges on clients

Care and maintenance for law firms expense

Maintain the trust account.

Maintenance of legal as well as ethics compliance.

Legal accounting focuses much on compliance with relevant laws, particularly in aspects of trust accounting and time billing. A lawyer accountant must determine the intricacies that guarantee precision and compliance-very crucial to avoid legal effects.

Elements of Law Firm Accounting

Knowing the foundational elements of law firm accounting serves legal practitioners to implement effective systems. These are:

1. Trust Accounting

Among the most important areas of legal accounting is trust accounting. This refers to managing client money that is placed in trust by an attorney. Generally speaking, it is used to cover other financial obligations that are commonly incurred in connection with legal services, such as fees and expenses. To have a clean money handling, there must be distinction between trust accounting and operational funds of the law firm.

An accountant in a law firm should be in a position to maintain accurate records of every transaction involving client trust funds. This would protect the funds of the clients, with the law firm being in line with both legal and ethical standards.

Key aspects of trust accounting are:

Separation of Client Funds: Client funds that are in trust should never be mingled with the firm’s operating funds.

Recording: The transaction should be recorded as soon as possible to avoid discrepancy.

Compliance: Trust accounts, for example, interest from client monies will be followed as word goes.

Accuracy in maintaining trust accounts protects clients’ interests, confirms compliance, and gives the trustworthiness character to the firm.

2. Time and Billing Management

Time and billing is the main activity for the law firms. Attorneys have to track the amount of time spent on behalf of clients and send out invoices pertaining to the same. Time and billing management ensures that lawyers get paid for work and clients are charged appropriately.

Advantages of good time and billing practices:

Accurate invoices: Lawyers will provide clients with a detailed invoice of the time spent on cases.

Improved Cash flow: Time tracking will enable the firm to recover its cash from the customers as soon as it delivers its service.

Clear Billing: Clients are always keen to know exactly how their money is spent; thus, they will be gained trust in the service

A wrong or a wrong time track may find the client and this hurts the firm.

The incorporation of reliable time-trackers such as the system reduces some errors leading to proper cash management.

3. Financial Reporting and Compliance

Any successful law firm depends on financial reporting and compliance. An accountant of a law firm agrees on and prepares the financial statements of the legal firm, including balance sheets and income statements and cash flow reports to make sense of the firm’s financial standing and comply with the legal requirements.

Critical elements of financial reporting and compliance include

Internal controls: Internal controls should be in place to ensure fraud prevention and accurate financial records.

Tax compliance: The lawyer must ensure that the firm is obeying tax requirements, including income taxes, payroll taxes, and sales tax if applicable.

Preparation of financial reports: Preparation of financial reports can be carried out periodically. They assist in performance monitoring and decisions that will take one to the future.

Effective financial reporting ensures that law firms are not also exposed to the legal issues that may result from financial mismanagement. Standards in accounting and regulatory compliance ensure trust with clients and other regulatory bodies.

Role of Mehasa Consulting for Accounting in Law Firms

Professional guidance on account management for a law firm makes all the difference. The services offered by Mehasa Consulting prove very beneficial, catering to specific and personalized support on account management for law firms, which is useful in managing financial activities of law firms as well as meeting the legal requirements.

Specific Expense Accounting, Tax Planning and Accounting Software for Law Firms

Managing the finance of a law firm can be quite complex. Many costs to track, taxes to prepare for, and myriad duties to the legal world can easily boggle the minds of even the most seasoned practitioner. However, without sound financial management, a law firm has less than an optimal opportunity to remain viable or poised for expansion. And then we will explore the most important topics for law firms on Expense Tracking and Budgeting, Tax Planning and Preparation, with the Top Law Firm Accounting Software- focusing on how Mehasa Consulting can help your law firm navigate those complexities.

Expense Tracking and Budgeting for Law Firms

Why Is Expense Tracking and Budgeting Important?

A very important aspect of a business’ financial control is expense monitoring and budgeting, and law firms are no different. Attorneys must be able to monitor daily expenses with long-term objectives in mind so the firm can be assured to be financially sound, compliant, and prepared for any growth opportunities.

Primary Components of Expense Monitoring and Budgeting

1. Tracking Firm Expenses

Law firms are involved with all types of operational expenditure that needs to be well tracked. These may consist of:

Salaries and Benefits: The cost of attorneys, paralegals, and support staff.

Office Supplies: Paper, legal pads, ink, etc. for day-to-day operations

Rent and Utilities: Overhead of office space and utility services.

Marketing and Advertising: Expense on campaigns for the promotion of services offered by the law firm

Technology and Software: Subscription to legal research tools, case management software, accounting tools.

All law firm expenditures accounts should also be classified by lawyers. They can track what is being spent where thus pointing out the points of overspending in the firm and consequently correcting errors.

2. Planning how to finance future needs

Budgeting saves the essential resources for future growth in a firm but maintains its stability in finance. To prepare a yearly budget, a law firm has to strategize for business expansion. In general, when a firm looks to increase headcounts in the staff, open up new offices, or spend on marketing activities, it must pre-allocate resources.

Forecast Income and Expenditure: Budgeting will help the firm anticipate its revenues and operational costs on which it will base its financial decisions.

Assess Profitability: With a budget, a law firm will be in a position to assess its financial health and hence compare actual expenditure against budgeted amounts and strategies for achieving better profitability.

This provides a law firm with good budgeting, meeting financial obligations, and preparing them in case there is a surge and growth for the firm.

Hiring experts like Mehasa Consulting helps you develop an authentic and viable budget that does not misrepresent what happens in your firm.

Tax Planning and Preparation for Law Firms

Why Tax Planning and Preparation are of Great Importance

Just like any business, proper tax planning and preparation are quite essential for the realization of the objectives. Law firms, in this case, are no exception. The owners and practitioners should be able to sail through the intricacies of the tax laws to reduce their liabilities or comply with the tax regulations.

Strategies for Effective Tax Planning and Preparation

1. Minimize Tax Liabilities

An effective tax plan can help reduce the burden of taxes of a law firm. The ways include:

Exploiting Deductions: Finding out all the expenses that are related to business that can be deducted during operations. These may be office supplies, client meals, or legal research costs.

Structuring Your Business: An LLC, S-Corp, or a Partnership would have a great impact on your tax liabilities. Seek proper consultation from your tax expert to get the right structure for your firm.

Tax-Deferred Contributions: Contributions to retirement plans in the form of a 401(k) or other pension plans reduce taxable income, which means that overall taxes will be low.

2. Proper Return Preparation

There must be accurate return preparation to avoid penalties and also for the law firms to be on the right track. Thus, owners of law firms:

Report all income: Billable hours, retainer fees, among other incomes.

File on time: Submissions of the tax return should be prompt to avoid late fees with interest added.

Review for Errors: Double-check tax filings for accuracy to avoid costly mistakes which may draw in audits or penalties.

Professional consultants, such as Mehasa Consulting can help law firms benefit from proper planning and preparation that will ensure conformity with tax regulations while minimizing liabilities to them.

Law Firm Accounting Software

Why Invest in Law Firm Accounting Software?

Proper accounting software can help streamline law firm finances. Using the appropriate tools, attorneys can improve process efficiency, accuracy, and adherence to regulation. Here are some of the best accounting software law firms should consider using:

1. QuickBooks for Law Firms

QuickBooks: This is the accounting software which most of the law firms trust because it provides an easy, user-friendly interface for the owner of the law firm to classify the trusts of each client and transparent activities concerning the trust.

Some basic features of QuickBooks involve:

Trust Account Management: Enables the categorization and tracking of client trust accounts separately from the operating fund.

Customizable Invoicing: Helps in forming detailed invoices on billable hours, retainers, and expenses.

Financial Reports: QuickBooks automatically features reports such as balance sheets, profit and loss statements, and tax reports for a firm’s informed financial decisions.

Being QuickBooks customizable, it is the best application for the law firms, which can be configured based on the law practice’s need for legal financial management.

2. Clio

The other most popular accounting software specifically designed for law firms is Clio. It is much more comprehensive because it offers case management features along with accounting.

Key advantages of Clio are:

Time and Billing: Track all the billable hours and create invoices directly from the time logs.

Client Trust Accounting: Manage client trust funds easily and ensure legal compliance.

Reporting and Analytics: Utilize in-built reporting tools for determining the financial health and firm performance.

Clio is an all-in-one service that can be very effective if your law firm requires case management to come together with accounting within one neat tool.

Mehasa Consulting: Your Partner in Law Firm Financial Management

While accounting software can be productive for streamlining financial tasks, it will be best to work with a dedicated accounting professional to get your law firm’s financial management running at its best. Mehasa Consulting offers bespoke accounting solutions to law firms. This means that through it, we are able to help clients in effective expense management and tax planning and budgeting.

How Mehasa Consulting Can Assist

Expense Accounting and Budgeting: Mehasa Consulting can help design a detailed, realistic budget and track firm expenses to optimize your financial resources for growth.

Tax Planning and Preparation: The expert team will guide your firm through tax planning strategies, ensuring the proper filing of tax returns.

Software Integration: Mehasa Consulting can assist in selecting and integrating the right accounting software for your firm, ensuring it works seamlessly with your financial processes.

By partnering with Mehasa Consulting, law firms can focus on providing excellent legal services while leaving the accounting, budgeting, and tax planning complexities to the experts.

Improving the Law Firm’s Finances: Features of Accounting Software and Consulting from Mehasa

Any law firm’s success will depend on its financial management. Effective financial management is the key because proper accounting tools and services simplify financial operations, ensure compliance, and provide invaluable insights for strategic growth.

Here are the features of leading accounting software:

Zoho Books, Xero, and Clio, with the role that Mehasa Consulting can play in helping law firms achieve optimal financial practices.

Key Features of Accounting Software for Law Firms

1. Zoho Books

Zoho Books is cloud-based accounting software for a law firm, with a user-friendly interface, aiming at automating financial management for the firm. It supports heavy customization and add-ons so that the software can be suited to specific needs.

Important Features:

Invoicing: Generate professional invoices using customizable templates

Payment Reminders: Automatic reminders to clients to pay

Automated Report Generation: Reports for in-depth insights about finances

Mobile Portal: It is accessible at any time and any place.

Client Portal: The client can access the billing and payment details, thus enhancing transparency with clients.

Inventory Tracking: Supplies and office management are tracked.

Integrations: Connect other tools to make workflow processes simple.

Audit Trails: This ensures that the change made is traceable.

Since it has its features with much strength, Zoho Books saves time and makes the managing of law firms easier on financial aspects.

2. Xero

Xero is an accounting software that is feature-rich and user-configurable-it streamlines the accounting process for the law firms.

Bill and Invoice: Bills and invoices clients right away.

Online Payments: It enables customers to pay through secured online payment systems.

Timekeeping: It can easily track time to charge to clients.

Mileage Tracking: Tracks travelling costs easily.

Statement Reconciliation: Reconciles bank statements to ensure accuracy of the record.

Payroll Management: Manage the payroll process for a staff member.

Tax Preparations: Eliminates all the different types of tax files because it provides an integrated feature.

Multiples Currency: For worldwide users.

Recurring Payments: Establish your retainer or repeating service schedule.

The adaptability that Xero offers with countless features, therefore, will allow law firms with a vision in mind about moving away from manual management of the bookkeeping to streamlined ways by partnering.

3. Clio

Clio is easy-to-use accounting and law practice management. Its core function is supposed to have all the finances under one management system; it is meant to try simplifying compliance work.

Bookkeeping: Maintain everyday financial transactions.

Time tracking: Record all hours work on client cases accurately.

Trust accounting: Stay complying with legal trust account standards.

Billing and online payment: Streamline your bills and accept online payments.

Payroll and Tax: Streamline payroll, tax for employees.

Financial Reports: All financial analysis reports are provided.

Client Management: All clients’ financial information is saved in one place.

Clio ensures transparency of the law firm, streamlines its finances, and remains in compliance.

How Legal Accounting Services Improve Law Firm Finances

1. Financial integrity and transparency

A clear framework for recording financial transactions will be evident through proper accounting and therefore transparency to clients and other bodies of regulation. In such record, the firm will, therefore, be able to show the responsible management of funds, thus creating trust with clients.

Maintain compliance with regulatory standards.

Produce accurate financial statements in case of audits.

The effective accounting practices ensure confidence and long-term relationships with clients.

2. Better Decision Making

Financial management becomes the core of any properly informed decision. An experienced lawyer’s accountant can:

Decide whether a thing can be profitable or not cost-effective.

Understand operation efficiency.

Discover growth opportunities due to trends in financials. All this helps in strategic allocation of resources and proactive shifts in business strategies to handle the shift in the market and make use of the scope for growth.

Mehasa Consulting: Your Partner in Legal Financial Management

While accounting software offers great power to the firm, it always requires expert help to unlock this full value of financial activity. Mehasa Consulting specializes in customized financial management solutions for law firms while helping guide you through the nuances of expense tracking, budgeting, and tax preparation.

How Mehasa Consulting Gives Value

1. Personalized Financial Strategies

It offers the organization with personalized financial strategies along with hundreds of law firms. It includes all processes, right from setting up a robust accounting system to developing efficient budgets which will ensure your law firm is always geared towards growth financially.

2. Cost Management

Once the costs have been properly tracked and categorized, Mehasa Consulting identifies what it can cut on and allocates what resources are available judiciously.

3. Tax Planning and Compliance

Tax laws are not straightforward; however, Mehasa Consulting makes them easier for your company. They offer:

Efficient tax planning that diminishes liabilities.

Precise preparing of taxes to prevent fines or penalties.

4. Integration and Optimization of Software

Mehasa Consulting will also find the law firms their optimum accounting software integration to smoothen workflow and performance.

Whether by the type of Zoho Books, Xero, or Clio, the company’s employee is going to make sure the kind of accounting software one chooses really answers their requirements.

5. Financial Reporting and Insights

Detailed financial reports through Mehasa Consulting give you actionable information in support of strategic decisions. Understand how your firm is faring in terms of its financial health and identify areas of improvement.

Role of Legal Accounting in Risk Management, Client Relationships, and Law Firm Growth

Good legal accounting is one of the foundation pillars that will keep a law firm healthy and growing. Legal accounting practices directly influence the success of the firm, from risk management and client relationship building to strategic resource allocation and tax compliance. Accurate financial records and transparency help reduce risks, build client trust, and set up the firm for future growth. This article discusses legal accounting in the context of risk management, client relationship management, resource allocation, financial planning, and regulatory compliance. We also look at some common legal accounting errors and how Mehasa Consulting can help law firms avoid these.

Risk Management in Law Firms through Legal Accounting

1. Early Detection of Financial Issues

Any law firm needs proper account monitoring and reconciliation to manage risk efficiently. Legal accounting would ensure the identification of discrepancies early enough such that the potential problems will not arise to be major roadblocks. Routine reconciliations of accounts and identification of financial irregularities at an early stage help the law firms avoid errors that could lead to potential financial losses or failure to uphold the requirements of any regulations.

Early Problem Resolution: Catch small deviations in time so they do not mutate into complex issues that require more expensive cures.

Risk Minimization on Operations: This is also when the identification of problems, such as being over-allocated with money or having lost invoices, can avoid financial pressure on the company.

2. Anti-fraud Practices

Legal accounting significantly focuses on fraud prevention. Accurate accounting creates a clear financial environment; therefore, it discourages fraud. The more difficult it is to notice financial malpractice by a firm in developing tight control and oversight of its transactions, the more unlikely the chances are. Legal accountants ensure that

Client Trust Accounts are Kept Separate: Maintaining operational funds separate from the client trust accounts enables compliance with the regulatory requirement.

All the transactions registered reduce the chances of fraud and make all the fiscal activities of a firm public.

Audit Trails: A system that keeps a log of every financial transaction of the firm at any given time will definitely make it easier to have an audit on its financial activities.

Client Relationship Management and Legal Accounting

1. Accurate Billing to Enforce Transparency

Open, accurate, and timely billing of legal accounting practices create a relationship of trust and openness with the client. Clients are likely to be loyal to a law firm if:

They know the Fee Structure: Proper billing and proper explanation of costs makes the clients understand what they are being charged for.

They get Invoices at the Right Time: Automated billing systems ensure that invoices are sent at the right time, thus avoiding delays in payments and ensuring smooth flow of finances.

Access to Billing Information: Services that allow clients to view and manage their invoices or payments give assurance.

2. Communication with Clients

Legal accountants also help as a form of efficient communication from the firm to clients on the status of accounts. Whether giving an update, answering questions regarding charges, or responding to client queries, it is ensured that:

Client Queries are dealt with immediately: Clear concise communication will clear any confusions or concerns the clients may have.

Financial Transparency is Guaranteed: By proper administration of clients’ trust accounts and keeping them informed, accountants can ensure that their clients are never kept in the dark about their financial standing.

Resource allocation and strategic financial planning.

1. Resource Optimization

Proper law accounting effectively helps the firms to better allocate the resources through alignment of their financial investments with strategic goals. With proper financial records, law firms can:

Accurate accounting will help businesses predict revenues, costs, and planning for investments in future technology, hiring, or office expansion.

Identify opportunities to save cost: Periodic examination of financial reports will reveal areas where costs could be reduced without jeopardizing service quality.

Set and track financial goals: Accounting systems enable the law firms to track and adjust the budget percentages they allocate to specific goals.

2. Supports Growth and Expansion

The more the complexity of the finances is, the bigger the size of the law firm. Accounting systems can expand when the firm expands its activities and, therefore, can be strong and in line financially. Accounting will help the developing law firm in the following:

Future needs: From the historical financial data, accountants can predict the need for new hires, investments in technology, and other resources as the firm expands.

Make Informed Decisions: Financial insights provide the company with the information required to decide on openings of offices, new staff and other expansion-related activities.

Operate Efficiently: With right accounting, as businesses expand, the business can continue to operate efficiently as cash flow is managed considering budgetary constraints.

Financial Planning, Tax Compliance and Regulatory Compliance

1. Tax Planning and Compliance

The tax obligations of a law firm are unique and need to be managed with great precision. Legal accountants ensure that all incomes and expenses are recorded correctly so as not to pay an enormous amount during an audit or penalties. By understanding the innumerable tax laws, accountants can help a law firm advance on every possible deduction or credit relating to operating costs, client expenses, and employee benefits.

File Taxes in Time: A professional accountant will ensure that all papers are filed in good time and hence avoid paying fines, which ensures that the firm is tax-compliant.

Comprehensive and easily accessible Tax Records: A professional accountant ensures that legal accounts maintained about tax records are adequate to easily prepare documents for auditing.

2. Adherence to Regulations

There are heavy loads of laws for lawyer practices at federal as well as at state level. Non-compliance to these can invite heavy fines, lawsuit actions or even loss of licenses. Accountant to the legal firm makes sure reports are accurately filed because the financial activities registered there will be used for tracing the regulatory and sector compliances of law firms.

Timely reporting: compliance requires routine financial reporting, which is in many cases required; legal accountants ensure that reporting is done in due time; hence, no submission which is late or the failing to meet the requirement.

Common Mistakes of Legal Accounting and the Avoidance

Legal accounting is a must for a law firm, but mistakes are very frequently committed by law firms, which hamper their finance. Below are two common mistakes discussed, and how Mehasa Consulting can help in not committing them:

1. Wrong maintenance of financial books

The most common problem of legal accounting is that the books of accounts are not well kept with updated financial records. Errors in accounts might come from the usage of obsolete systems or even manually tracking, which consequently leads to erroneous financial reporting. Mehasa Consulting helps law firms with:

Having strong accounting software: This involves proper automation of transaction tracking, invoicing, and reporting using the right software.

Training Staff: Educating all in financial management on the need for maintaining clean records.

2. Failure to Properly Manage the Trust Account

A big mistake is the failure of law firms to properly maintain client trust accounts. Such could result in severe penalties. Separation of trust funds from operating funds and proper monitoring of such funds must be accomplished. Mehasa Consulting offers:

Expert Trust Account Management: Ensuring segregation of funds belonging to the client and proper record keeping.

Regular Audits and Reconciliations: Systematic checks to ensure that all the trust account transactions are properly recorded and in compliance with all rules and regulations.

Common Legal Accounting Mistakes and How Mehasa Consulting Can Help Law Firms to Avoid Them

Legal accounting forms the backbone of any law firm in the proper running of its affairs. Unfortunately, most firms are still prone to common accounting mistakes that attract serious disciplinary action, heavy fines, and loss of business. These range from mishandling trust accounts, inconsistency in practices with regard to billing, and failure to reconcile accounts regularly. This article will discuss the common legal accounting mistakes and how Mehasa Consulting can help law firms avoid these mistakes.

1. Inefficient Management of Trust Account

Risks involved in poor management of the Trust Account

Trust accounts form the lifeline of any law firm. Client funds are held in such accounts that have to be maintained entirely different from the firm’s operating account. Poor management leads to the worst, and a few of them include the following:

Disciplinary Action: Mismanagement might lead to disciplinary action by the regulatory authority.

Fines and Penalties: In case the client’s and the firm’s funds are commingled or mismanaged, massive penalties and fines lie in wait.

Loss of License: In extreme cases, negligence of trust accounts may result in loss of practicing license

How to Avoid Trust Account Errors

To avoid such risks, efficient trust account practices may include the following:

Timely Transaction Reviews: All trust account transactions must be reviewed according to relevant legal and ethical standards.

Accurate ledgers: All transactions relating to a trust account must be detailed in and correct.

Periodic Audits: Periodically inspect that client money is under control and that accounts reconcile.

Mehasa Consulting provides law firms with tailored accounting so that the trust accounts are run correctly and in accordance with all current legislation. Our accountants help law firms set up firm trust account management practices and conduct periodic audits so such errors do not occur.

2. Inconsistent Billing

Effect of Inconsistent Billing

Most of the firms are guilty of the following common errors: Non-standard billing practices. This lack of standardization leaves way to confusion to the clients with a major adverse implication on credibility and subsequent disputes. On this aspect, some errors one makes while creating bills comprise of:

Not Transparent Rates: the rates were not communicated before provision.

No Itemized Invoices: Proffering obscure invoices without the services rendered and their costs.

Poorly administered billing practices are the causes of alienation to clients, late payments, and damaged reputations.

How To Standardize Billing Practices

Standardized billing ensures clients get clear and professional billing. Some standardized billing procedures are:

Plain Communication of Rates: Ensure that clients are put in the know about all the hourly rates, retainer fees, and other billing procedures before any work is done.

Itemize and present the invoices which contain the services offered, time taken, and any other cost incurred during the service provision.

Legal Billing Software: Vendors can offer software exclusively designed for use in law firms. It assists automatically to create itemized invoices as well as keeping records of payment received.

Mehasa Consulting can help a law firm to simplify its billing process. We can take a firm through the process of installing legal billing software, which makes it easy to come up with an invoice, avoids mistakes, and allows firms to track clear and transparent billing systems.

3. Disregards Legal Compliance

Legal compliance is another aspect in which law firms go wrong. Lack of keeping abreast with applicable laws and regulations can prove to be fatal:

Audits and Fines: If there are issues in following rules regarding tax, trust account, or other financial practices, then audits are called for and heaviest fines will be imposed.

Dent in Reputation: Such acts will further create skepticism in the minds of clients, thus resulting in loss of financials also.

How to Stay Compliant

Lacking financially, law firms will need to follow changes in the law in their own jurisdiction. Some ways whereby compliance errors can be minimized include;

Stay Current: Carries an update of current statutes, regulations, and orders affecting how financial practices are made.

Training and Conferences: Training programs, webinars or workshops: Stay the firm updated with regulatory requirements on the changes.

Hire Legal Accounting Experts: An accountant well-versed in the practices to ensure that all of industry-specific statutes are maintained.

Mehasa Consulting makes sure you are updated regarding any legal and financial norms which occur. We make your accounting procedures fall within the contours that the current regulatory requires and keep your law firm abreast of all that occurs today.

4. Irregular Accounts Reconciliation

Risks Enclosed in Irregular Reconciliation

Irregular reconciliation of operational and trust accounts exposes firms to serious financial errors. Lack of observation further exposes firms to:

Unidentified Mistakes: The differences in accounts shall not be identified for a long time which can create complications in the financial statements.

Risk of fraud : The firm might not identify fraudulent activities at the right time, which can present a threat to the financial stability of the firm.

Mismanagement of Funds : The funds cannot be tracked properly, and the chances of overdraws or missed payments may occur.

How to Ensure Proper Reconciliation

Law firms should adopt the routine reconciliation of both operating and trust accounts. This is through:

Monthly Reconciliations: Allocate particular time in monthly bank statements to cast through and reconcile all accounts. Moreover, all the transactions are recorded accurately.

Verify Transaction Details: Verify if all deposits, withdrawals, and transfers are correctly recorded as they are matched with client records.

Apply Accounting Software: Apply software which will automate reconciliations and save time and lessen the chance of errors.

Mehasa Consulting provides law firms a reconciliation process for the professional. We ensure that your firm’s financials are corrected and current by reviewing all accounts from time to time.

5. Not Applying The Right Technology

The Old Systems Risks

Despite the latest accounting technology being available, many law firms use outdated systems or still operate manually. This results in a highly inefficient and imprecise financial management system for such firms. The frequent problems are listed below:

Slower Processes: Labor costs will increase and the speed of operation in the firm will decline when manual tracking and paper-based systems are used.

Inaccurate Reporting: The financial report will become a tiring and error-prone activity because of the lack of automated tools.

Lack of Integration: Isolated systems will deny sharing financial data across various platforms, meaning that generating reports in real-time and follow the progress is impossible.

Accounting soft Adoption of Modern Technology

ware modernized will highly aid law firms by having an exhaustive set of features custom made for the legal profession in every manner. For example

Automated billing: The sending of a bill is automatically processed and tracking real-time payments.

Financial Reporting: Instant generation of cash flow, profits, and expenses financial statements

Cloud-Based Solutions: Web-based cloud-based accounting that is easy, live update, and data safety

Mehasa Consulting ensures the correct accounting application for law firms can help firms capitalize on the synergies that come with its implementation by avoiding errors, ensuring enhanced productivity, and generally the proper performance of a law firm.

Increasing Financial Probity in a Law Firm: Education, Client Communication and Accounting Firm Selection

Proper management of the financial affairs in law firms ensures continuity, adherence to set rules, and good relations with clients. However, challenges that could derail such efforts include a failure in training staff members, difficulty in communicating clearly with the client, and the selection of an appropriate professional accountant. This piece explains how to overcome those challenges and provides practical hints on choosing an ideal law firm accountant to lock in your financial destiny.

Importance of Right Training and Education in Legal Accounting

Risks of Poor Training

A highly trained accounting department is a must to maintain the firm’s financial integrity. Lack of proper training, however can result in mistakes that are detrimental to the reputation and financial condition of the firm. The most common issues are;

Financial Maladministration: There is a significant risk of making errors when bookkeeping, managing trust accounts, or tax returns.

Compliance Issues: Lack of knowledge about legal accounting standards can lead to non-compliance, penalties, or even lawsuits.

Ineffectiveness: Untrained staff will typically take longer to complete tasks, leading to delays in key financial processes.

Effective Training Solutions

To mitigate these risks, law firms must provide their accounting staff with ongoing training. These include:

Professional Development: Provide access to workshops, online courses, and seminars on accounting principles and legal-specific practices.

Engage Legal Accountants with experience: Allow consultants, such as Mehasa Consulting, to come and train your team on the best practices of legal accounting.

Standard process: Have clear guidelines and procedures for performing all financial activities so that fewer mistakes are made and productivity increases.

Through training, law firms will arm their employees with knowledge on managing finances properly and keeping them in line with requirements.

Role of Clear Communication in Client Relationship

Poor Communication on Billing Habits, Payment Expectation, and Account Status causes Misunderstandings leading to Damages in client trust. Most of them are usually associated with:

Payment Delay: The client has not been notified of when to pay by the required time.

Conflicts: Clients will be confused concerning charges that they do not understand.

Poor Client Satisfaction: The relationship becomes poor, as the clients get frustrated because of the inconsistent updates given to them about the account status.

Effective Client Communication

Clear communication protocols in place will be a building block for the law firms towards constructing a trust with smooth financial transactions involved. Among the best practices of the protocol, following points are included;

Transparent Billing: Make sure, at the start of your relationship, billing rates, services, and deadlines are put on notice.

Provide the client with periodic updates about their account status, including outstanding balances or changes in payment schedules.

Accessible Channels of Complaint: Provide the client with various channels they can access to get their answers or complaints, whether by e-mail, phone, or through a client-unique portal.

Using Mehasa Consulting experience would facilitate the refining of communication so that law firms keep clients satisfied and informed.

How to select an appropriate accountant for Law Firm

A law firm requires the right accountant for good financial management and for success in the long term. The financial needs of a law firm are quite different, requiring a higher level of expertise. Here’s how to find the right accounting professional for your firm:

1. Assess the Needs of Your Company

Before starting your search, know what your company needs. Questions to ask include:

Scope of Services: Do you require bookkeeping, tax preparation, trust account management, or financial planning services?

Business Scale and sophistication: Large businesses with a big number of high volumes of transactions might demand more sophisticated accounting solution and expertise.

Special Considerations: Multi-currency, international regulations amongst others

Definition of those needs will help close up or narrow down your search until such a time that you see an accountant who has the relevant skills.

2. Qualifications and Certificates

Quality and reliability cannot be compromised; therefore make sure that the accountant chosen is qualified and certified appropriately with most notable being:

CPA:A CPA qualification is a great indicator of being an expert in accounting and tax practices.

Specialization in Accounting for Lawyers: Identify accountants that have specific training or certification in legal accounting. Many organizations, such as AICPA, offer specialized training in this area.

Relationship with seasoned attorneys such as those at Mehasa Consulting ensures best-in-class financial professionals for your firm.

3. Assess Technology Knowledge

Technology is the foundation of any modern accounting. But an experienced legal accounting professional makes sure that technology is applied in the right way. Know-how of advanced accounting software is crucial; therefore, test know-how of:

Software particular to the practice of law, like Clio, Zoho Books, or QuickBooks for Law Firms.

Features include trust account management, automated billing, and financial reporting.

Accountants who can integrate and optimize these tools for your firm’s needs will save time and make fewer mistakes.

4. Communication and Collaboration

Select an accountant who is not only technically skilled but also communicative and collaborative. Seek one who:

Knows Legal Practices: A person who understands the specific financial challenges of law firms.

Explains Things Clearly: A good accountant should be able to explain complex financial matters in simple terms.

Collaborates Proactively: Accountants who frequently communicate with your team and provide actionable insights will add great value to your firm.

Mehasa Consulting Advantage

In choosing the right accountant for your law firm, Mehasa Consulting becomes a trusted partner. This is how we can be of help

Legal Accounting Expertise: We focus on law firm-specific accounting practices in order to ensure accuracy and adherence to norms.

Customized Solution: Depending upon your specific firm’s requirements, we offer customized solutions that are based on the firms’ objectives and the complexities involved.

Training and Development: At Mehasa Consulting, we train your staff for maximum financial management abilities.

Technological Implementation: We also offer the service to support designing, implementing, and streamlining the accounting software of your organization to help maximize the performances.

Client Communication Strategy: From transparent billing to frequent accounts, we will help build the clear communication protocols in relation to sowing the seed of trust and satisfaction to your clients.

Identifying the Best Law Firm Accountant: The Cornerstones for Success

Managing finances for a law firm is a unique challenge that requires expertise not only in accounting but also in the specific needs of the legal profession. The right law firm accountant ensures compliance, financial integrity, and optimized financial performance at your firm. Here’s a guide on what to look for when choosing the right accountant for your law firm, with a special focus on Mehasa Consulting, an expert in legal accounting.

1. Look for Experience in Legal Accounting

Why Experience Matters

During the hiring process of an accountant for your law firm, experience should top the list. Legal accounting covers aspects that are unique to it, unlike general accounting practices, for example:

Client Trust Accounts: Legal accountants separate client money from operating money. The accountant must know how to handle trust accounts so that client funds are not comingled which can be serious compliance violations.

Fee Arrangements: Lawyers firms have rather complex fee structures among others including the hourly billing, retainer agreements and contingency fees among others. Your accountant should know how to accurately capture some of these fee structures.

Reporting: Attorneys in law firms are subjected to very stringent reporting that the regulatory bodies demand of them. A seasoned accountant is very conversant with all legal reporting procedures to adhere to and avoid penalties from violations.

Mehasa Consulting Advantage

Mehasa Consulting has been working with law firms of all sizes and in different specializations for years in legal accounting. Their experience with trust accounts, complicated fee structures, and ensuring compliance with the law makes them the best partner to work with your firm to ensure that the accounting needs of your firm are completely met. Its solutions ensure that your financial operations are not quite bothered with real-world challenges.

2. Tech Proficiency Check

Role of Technology in Legal Accounting

Accounting is hot today as a discipline inside the legal environment. The ideal efficient law firm accountant has to be able and versed in a variety of software tools which assist in expediting the financial processing mechanism of a law firm. Some of the most important tools include:

Clio: The popular practice management system that has recently included elements of accountancy.

QuickBooks for Law Firms: Efficient finance management and trust accounts in law practice.

Zoho Books: It is relatively inexpensive for small to medium-sized law firms; multi-currency, auto-generation of invoice, follow payments.

The accountant, knowing all these tools, ought to be very skilled in applying them to allow it to perform auto-functions like invoicing, tracking of payables, and performing of financial reports. Thus, knowledge in technology would make somebody reduce time and reduce making many errors.

Considering data security

Legal data is sensitive and thus, guarding information of the clients becomes essential. Hence, it is necessary to have secured file sharing, data encryption, and backup procedures set in place with a strong approach to the protection of data and adhering to the present legal standards in the industry will be relevant.

At Mehasa Consulting, we have adopted the latest accounting technology; all sensitive data are encrypted, and kept safely in safe systems so you can now focus on expanding your firm without worrying about data breaches or security concerns.

3. Fee Structure Analysis

Knowledge of Various Fee Structures

A lawyer may have various forms of billing; this helps in planning and budgeting. Commonly used forms of billing structures are:

Hourly Fees: Other accountants charge by hours that they place into the accounting activities of your firm.

Flat Fees: Other accountants charge by offering constant services through the use of flat rate fees that are predictable

Project-Based Fees: For a single task, like tax preparation or audit support, an accountant will require one-off fee

Choosing a Suitable Fee Structure

The fee structure should be balanced with value for money. Low-priced services, although seemingly attractive at first glance, could be very limited because of the lack of personal contact and also the lack of experience in legal accounting. Higher fees can be justified in terms of the value and efficiency that comes from experience and acumen of an accountant and lower costs of handling finances.

Mehasa Consulting is transparent and competitive with no hidden cost. We adjust our services to meet your firm’s requirements and give value for your investment.

4. Examine Communication Style

Why Communication Matters

Good communication is the way to maintain a good relationship with your accountant. Poor communication leads to misunderstandings, delays, and missed opportunities for improvement. Analyzing an accountant’s communication style may be done by following:.

Clarity: Is the accountant able to make complex financial concepts simple? A good accountant should clearly express financial matters so that you can understand your firm’s financial health.

Responsiveness: Does the accountant respond promptly to queries? A proactive accountant should not only answer your questions but also provide insight into your firm’s financial performance and recommend what may improve efficiency.

Regular Check-Ins: Regular check-ins with the accountant will enable you to identify and correct financial issues of your company in their early stages.

Transparency and Clarity at Mehasa Consulting: Our accountants will provide you with constant insight into your firm’s financial condition and are always available to answer questions or discuss strategies to improve financial management.

Is Outsourcing Legal Accounting Right for Your Firm?

Benefits of Outsourcing

Legal accounting services are one of the most strategic moves for any law firm. Among some of the key advantages it offers, the following stand out:

Expertise at Your Fingertips: Accounting for law firms, especially in trust accounts, compliance, and tax laws, is highly specialized. Outsourcing can source such knowledge professionals.

Cost Efficiency: Outsourcing grants you “best-in-class” expertise without the expense of a full-time accountant or accounting department. That saves you some serious overhead and increases your probability of getting it right and on time.

Focus on Core Activities: Accounting outsourcing allows your core staff to stay client facing and focus on firm growth rather than just being immersed in financial management.

Mehasa Consulting: The Best Outsourcing Partner

Mehasa Consulting is one of the best outsourcing partners for legal accounting. We have numerous products such as trust account management, tax compliance, financial reporting, and much more to fit a law firm’s needs. Our experts are equipped with all the knowledge regarding legal finance to get you streamlined with full regulatory compliance.

Outsourcing Law Firm Accounting: A Strategic Approach to Cost Savings and Efficiency

Accounting is one of the essential components to run an entity in a law firm and yet very resource-intensive. It makes it so tough from the perspective of legal regulation compliance and managing trust accounts of clients. Cost-effectiveness and productivity, accuracy, and scalability of legal accounting can’t be availed by law firms unless and until they outsource servicing. That is precisely what Mehasa Consulting will provide: a separately positioned and distinctive law firm accounting outsourced service with key benefits from the firm. One will be for obvious reasons an intelligent law firm tactic for accounts outsourcing as hereunder delineated:

Its A Low-Cost Approach

Over Head Cost Reduction

It carries certain fixed costs beyond salaries by keeping in-house accounting. Benefits, training, software, and the need for an ever-upgrading technology can cost a lot and is too burdensome for smaller firms and firms that are growing fast, whose financial demands go up and down.

Outsourcing your law firm’s accounting functions allows you to take fixed costs and make them variable. You only pay for what you need, when you need it, without added salaries, benefits, training, or office space. It makes expense management easier, especially in fluctuating financial conditions of your firm.

The Mehasa Consulting Advantage

Me-has A Consulting provides flexible accounting services that suit the specific needs of your firm. Whether you have a small practice or are a bigger firm with several locations, outsourced services let you scale your accounting needs with a minimal overhead cost without keeping an in-house team on your payroll.

Focus Better on Core Activities

Let Your Lawyers Practice Law

For any law firm, success always depends on its capability to deliver excellent legal services. However, when lawyers spend a lot of their time managing their finances, there is a diversion of focus from the people they should be serving. The task of accounting should not encroach on the core competencies of legal professionals; the more they should practice their profession and represent their clients.

Free up your legal professionals to work on those cases that really matter with outsourced accounting services. Such free time will now be reinvested into the business development, client relationship and more important legal work. Therefore, it enhances productivity with increased quality of service.

Solution by Mehasa Consulting

Mehasa Consulting will handle all your accounting needs for your law firm so that your legal team can focus on growing the practice and winning cases. Our dedicated accountants ensure that your finances are in order, which means more time for attorneys to spend on client matters.

Advanced Technology Access

State-of-the-Art Accounting Tools

One of the major advantages of outsourcing accounting is access to advanced technologies that may be too expensive or complicated for small and mid-sized law firms to implement on their own. Outsourcing accounting firms invest in sophisticated tools to streamline processes, enhance accuracy, and automate tasks. This includes:

Automated Billing Systems: Ensures that invoices are generated correctly and promptly, reducing errors and delays.

It has highly advanced reporting systems, whereby you obtain real-time insight in order to manage or make decisions about the business affairs of your firm.

It safely handles all sensitive data received from clients using the highest secure protocols.

Mehasa Consulting’s Technology Integration

At Mehasa Consulting, we use cutting-edge software and technologies that are designed for law firms. Our expertise ensures the smooth running of your accounting processes, accuracy, and the latest regulations. With our innovative tools, your firm will benefit from real-time tracking of finances and enhanced reporting.

Improved Accuracy and Compliance

Risk of Errors Reduced

Accuracy is of utmost importance in law firm accounting. Deviation in financial reporting results can lead to extreme reactions like legal penalties, audits, and even loss of confidence among clients. Professional accounting firms specializing in legal services come equipped with the latest tools that minimize errors and comply with industry standards.

The accounting services outsourced will ensure that the financial reports produced are always accurate and legal. They are very much aware of trust accounting, tax reporting, and the compliance with the legal standards, and hence your firm will be safe from litigation.

Legal accounting is strictly governed with rules and regulations. Hiring professional accounting functions will ensure that your firm stays abreast of the latest tax law, trust accounting rules, and all other financial-related regulations to avoid the possibility of receiving penalties, sanctions, or disciplinary actions as a result of non-compliance.

Mehasa Consulting Expertise in Specialized Areas

With Mehasa Consulting, your company would have expert accountants experienced with legal accounting. All the financial reports from your company would be correct, accurate, and filed on time; this saves your company from some potential financial or legal errors.

Ease of Scalability for Your Business

Growth Adaptation

As your law firm grows so does your need for accounting, be it new team members to add, the new clientele to bring home, or in new areas to practice; your accounting requirements will increase. The trick is to ensure that your accounting systems can scale to support those needs.

Outsourcing legal accounting services means that you can scale your accounting services according to the growth of your firm. You can easily add and remove services as appropriate depending on the size and complexity of your firm without the necessity to hire new employees or investing in extra resources.

Mehasa Consulting offers scalable solutions

Mehasa Consulting gives you tailored accounting solutions that grow with your firm. You are expanding locally or internationally, and we have the capacity to scale our services in line with your growth requirements, providing you with seamless accounting support as you grow.

Reduce Risk

Be ahead of legal and financial risks

Legal businesses and accounting keep on changing constantly; therefore, the law firms often lag in new updates owing to a change in regulation, causing cost penalties through audits and reputational damage. Your firm’s accounting functions will be well taken care of if outsourced.

By partnering with a professional accounting firm, your firm is at the forefront when it comes to regulatory change. Outsource accountants will be abreast of the latest rules on financial regulations affecting a law firm, from trust account rules to tax laws, ensuring that your firm remains compliant and reduces the possibility of facing any legal or financial penalty.

Mehasa Consulting: A Partner in Risk Mitigation

Mehasa Consulting ensures that your firm is compliant on all legal and regulatory requirements. The experts on our team monitor the changes in the legal accounting environment to keep your firm updated, thereby reducing risks and protecting reputation.

Conclusion: Strategic Advantages of Outsourcing Accounting for Law Firms

Proper accounting in a law firm is very important for the financial stability and compliance of a firm. Cost savings, accuracy, and focus on what matters most-servicing clients and building the practice-through outsourcing of the accounting of a firm are guaranteed.

Mehasa provides you special legal accounting services for your firm. Your account, therefore is in good hands so you can focus all your time on the practice. To have your financial management become simple so that your firm would always comply and make money? Contact Mehasa Consulting today.

Frequently Asked Questions

Q. What does a law firm require when it comes to accounting?

Accurate accounting can be achieved in keeping all the financial records different from each other, including the maintenance of a trust account that keeps client funds into different accounts. Secondly, it is essential to ensure monitoring of the billable hours, accounting by rules and regulations, and taxes settlement.

Q: Accrual or cash basis?

Most law firms prefer accrual accounting since it provides a more reflective view of financial health and recognizes revenues and expenses, rather than when cash exchanged hands.

Q. What accounting software for a law firm aids the firm with compliance?

Among the best accounting software for law firms are Clio, QuickBooks, ZohoBooks, and Xero. The applications feature functions designed to make financial reporting more streamlined while supporting compliance with legal standards.

Q. Is accounting helpful for law firms?

Accounting, indeed, is helpful to law firms since it maintains transparency in funds, compliance, and billable. Finance management, reduction of risk, and profitability are all ensured.